What If You Are Wrong? Overconfidence and the Pregnant Pause

I have been in Toastmasters for 28 years; I have gone weekly (we do take summers off) during those 28 years. In evaluating a speech, we often look for “ahs” and “ums” since those filler words detract from a speech. One of the helpful tools I have found is the pregnant pause: silence before your next sentence. A pregnant pause can smooth out a speech and add punch to the next sentence. I think the pregnant pause should be used more in life, as it leads us to consider what is going on around us.

In a 2007 study, Individual Differences in Adult Decision-Making Competence, the authors (Bruine de Bruin, Wändi; Parker, Andrew M.; Fischhoff, Baruch) look at financial decision-making as we age. One of the implications of this study is that as we age, we become more confident in our decision-making. Yet we also become more prone to errors and biases that can lead to a higher magnitude of negative outcomes. Simply put, as we age, we are overconfident in being right, and when we aren’t right, we create bigger problems for ourselves.

A pregnant pause in our financial lives might help us to avoid making errors from overconfidence. And it might lead us to outcomes that enhance our lives as well as the lives of our families.

Errors in Investing

Overconfidence in investing is particularly concerning. If we allow biases to play into our decision-making, the errors can compound in real dollars. This occurs daily with people deciding to sell to avoid market declines or to buy certain assets thinking they are the fastest growers. A false sense of precision can lead to horrible results. I think it is better to hit the broad side of a barn than try for the center of a bull’s-eye.

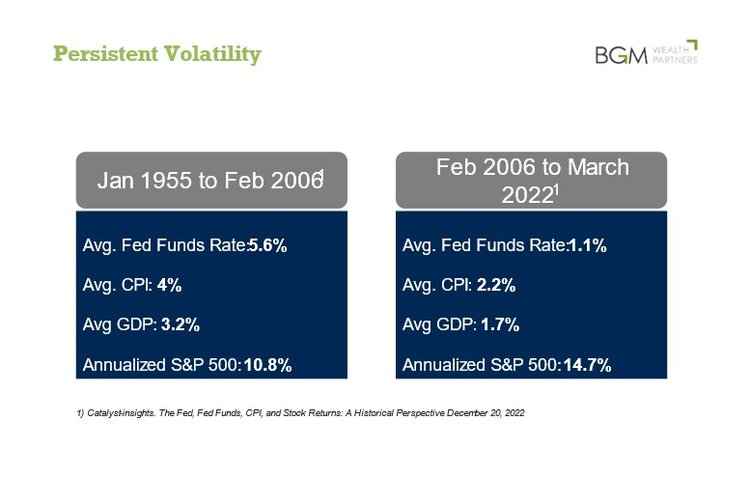

The chart below shows how much someone can err.

Draw an imaginary line down the middle. To the left is approximately 50 years of economic data, and to the right is about 15 years. Quantitative easing after the 2008 financial crisis took federal funds rates down dramatically, as well as inflation.

One of the outcomes of low interest rates is that the S&P 500 had higher returns over the past 15 years (past performance is not indicative of future results). Companies could borrow at low interest rates and use that money to grow their companies. Since March 2022, the Fed policy has reversed, and we are now back to a fed funds rate of 5%.

The question to ask now is, which side of that dotted line are we on? The left or the right? How confident are you in that answer?

If you think the left is where we are at (or heading back toward), cash and bonds have a role in portfolios they haven’t in years. And if money is more expensive (higher interest rates), certain stocks tend to do better/worse than others. If you think this past year is just a blip and we will continue more broadly with the policy on the right, then vice versa.

Again, I ask, how confident are you in your opinion? Confidence that one side is the only answer can get us in trouble. The reality is you can diversify a portfolio to allow for either answer to be right, while at the same time not hurting your portfolio if one side is more correct than the other.

Errors Beyond the Stock Market

While investing is an easy example, overconfidence can get in the way in many other areas. Here are two examples:

- Maxing out 401(k)s: When we are told to invest as much as possible into our 401(k)s and then that is all we do, we end up with a pile of money for retirement and confidence we did enough. Yet when it comes to spending that money, many people find they must pull so much out that they end up in higher tax brackets in retirement than they anticipated. And higher tax brackets mean we shell out more for taxes, which is less for ourselves.

- Estate planning: We implement a will/trust and believe our children won’t fight over money. I can share two examples of when this overconfidence gets families in trouble. First, mom and dad often want to keep fees down and trust that the child they name as trustee (instead of a corporate trustee) will get the job done. But inherent in the job of trustee is decision-making that not all their other children might agree with. So, they fight; the parents never intended this, but money causes it. Second, mom and dad trust that their children are ready to receive large sums of money, so they leave the cash outright to them. Within years, those children might have spent it all, leaving them without money and angry. In either case, a parent’s overconfidence in how they view the world versus how the world might truly be (after all, our children grow in ways we never anticipated) can damage familial relationships and sometimes sever them.

A Solution for Overconfidence: Pause

Combating overconfidence is as simple as asking, what if you are wrong? Instead of just assuming the best, assume the worst for a few minutes. Go down the path of how bad it could be. Then back off and decide on the likelihood of that outcome. Ask how to mitigate it. Ask how to diversify your risks in life. Consider the long-term ramifications of your short-term decision-making.

Pausing to consider if you are being overconfident may sound like too simple an exercise. But it isn’t. And we don’t do it enough. We are typically so focused on taking action that we don’t take the time to ask, what if?

Pausing should not just be an exercise you do alone. When we are with others, our overconfidence is often more pronounced as we want to look smart. But it is with others where the pause can have the most effect. When sitting with your advisors (financial advisor, attorney, CPA, insurance agent, etc.), use the pause to see what you are missing from their point of view. Being open to this can save a lot of money and even heartache.

And if you get good at pausing, consider joining Toastmasters. You can win a speech contest!

If you have questions or would like to learn more, contact Jon Meyer, CFP® at jmeyer@bgmwealth.com or send us a message.

The opinion of the author is subject to change without notice and must be considered in conjunction with relevant regulation, as well as subsequent changes in the marketplace. Any information from outside resources has been deemed to be reliable but has not necessarily been verified. Each individual has unique circumstances to which this information may or may not be relevant. Under no circumstances will this information constitute an offer to buy or sell and it does not indicate strategy suitability for any particular investor.