News + Insights

Access Our Wealth of Knowledge

Browse BGM’s collective financial knowledge across a wide variety of topics and industry specific insights, as well as the most up to date news on our firm.

Focus

Tax-favored Qualified Small Business Corporation status could help you thrive

Depreciation Allowed for Cannabis Companies on Tax Returns

Did your business buy the wrong software?

BGM Solutions: Strategies and Services to Address HR and Payroll Challenges

The kiddie tax could affect your children until they’re young adults

Hot Topic: Q1 2024 Economic Update

Amending Tax Returns After Receiving the Employee Retention Credit

Perform an operational review to see how well your business is running

Defer a current tax bill with a like-kind exchange

3 types of internal benchmarking reports for businesses

Reinvigorating your company’s sales efforts heading into the new year

Court awards and out-of-court settlements may (or may not) be taxed

Cannabis Industry Predictions for 2024

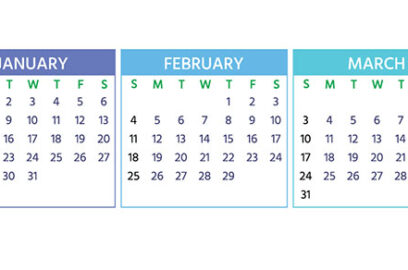

2024 Q1 tax calendar: Key deadlines for businesses and other employers