Moving On: Key Considerations for Individuals Considering a Change in Residence

Warmer weather, lower costs of living, and the ability to enjoy outdoor activities are all strong considerations making migration south attractive for many retirees. Purchasing a new residence to escape the winter weather becomes even more enticing when it also provides attractive income and estate tax benefits. However, if you are considering a change of domicile to ease your tax burden, be mindful that your former state may not let you go without a fight.

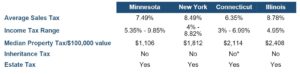

With significant differences in the application of income, inheritance, and estate taxes across states, the determination of domicile has become a significant financial consideration for many individuals. As more and more baby boomers enter retirement, the exodus from high-cost jurisdictions is increasing, particularly following the 2017 Tax Cuts and Jobs Act (TCJA).

In 2019, New Jersey led the movement outbound with 37 percent of its population heading out, followed closely by Illinois (33 percent), New York (26.2 percent), and Connecticut (26 percent).1 These states topped the list of jurisdictions with dwindling populations and dwindling tax revenues.

It is no surprise that states are directing increased resources to investigate whether their residents are truly leaving the state or just trying to escape higher taxes.

Tax-Friendly states2

*New Hampshire imposes an income tax on dividends and interest

Least Tax-Friendly States

*Connecticut imposes a gift tax (the only state currently doing so)

Residency or Domicile? There Is a Distinction

Residency can be established by physical presence in a particular jurisdiction, while domicile is physical presence coupled with intent to make the location your permanent home. An individual may have more than one residency, but only one domicile.

Spending significant time in a state does not establish domicile. You must also prove that you intend to make it your true permanent home. The best indicator of your intention is reflected by your actions and where you handle your affairs.

If you sell your home and do not return to your old domicile, your intent is clear. However, for most individuals, an abrupt severing of ties is not always possible. If you maintain a home, regularly visit, or maintain business and family connections in your old domicile, proving your intent to change domicile may rely more on subjective factors, and the burden of proving your intent to change domicile in an audit situation is on you, the taxpayer.

Subjective Factors

There are many subjective factors that may be considered in establishing or disproving intent during a state tax audit. Each is considered independently and weighed against the totality of circumstances.

If you maintain a residence in the prior domicile, is it more significant in size or associated expenditures? A new home that is less significant, coupled with maintaining your personal effects (personal items, art and pets) at the original home, may make it more difficult to prove the new location is your intended permanent domicile. Leasing your prior home or disconnecting the utilities during the “off-season” may support your domicile claim.

Where are your medical and financial as well as sentimental records stored? Where are your doctors and advisors located? Are you more active socially in the new state with boards and club memberships? Have you severed ties or changed membership status with organizations in your prior domicile? Do you celebrate holidays in the old or the new state?

While an examination of these factors may seem intrusive, they can be helpful in articulating intent.

Records Are Essential

Tracking and documenting time in and out of your prior domicile is important, but not foolproof. Many states—including Minnesota, New York, and Connecticut—consider 183 days the minimum amount of days absent for non-resident status. And all days in the jurisdiction count, regardless of purpose—even family holidays, celebrations, and dinner gatherings with friends.

Keeping a diary or calendar of all touchpoints with your current and former domicile is important, particularly in the first couple of years. Credit card activity, E-ZPass use, cellphone records, and plane tickets are all accessible during an audit.

While objective factors may not be as helpful in proving your intent, failure to follow through with the basic residency requirements can derail your domicile claim. Once physical presence is established, it is important to file a Declaration of Domicile in the new state (if applicable), file for homestead status (if applicable), register to vote, obtain a driver’s license, and register any vehicles and boats to be used in that state.

Prior tax filings and exemptions can cause problems if you fail to change your state filing status to non-resident or fail to deactivate resident benefits (such as homestead election) in your prior state. These administrative details can play an important role in supporting your domicile claim.

Estate Plan Considerations

Revisiting your estate plan is essential to ensure advance directives comply with local law and all provisions of wills and trusts are enforceable in your new domicile.

With many of the tax-friendly jurisdictions also providing favorable trust code and asset protection status to estates and trusts, it is important to review all estate planning documents to coordinate and preserve these favorable terms and protections.

Double Taxation

While you may be successful in declaring a new domicile, it does not mean you are exempt from taxes in your former domicile now or in the future, particularly if you maintain business interests, employment, real estate or spend substantial time in the former jurisdiction.

Income sourced from your prior domicile may retain its taxability. Some states, including Minnesota, can consider an individual a statutory resident if they maintain a home or apartment (owned or leased) within the state and spend more than 183 days in the state in any year, regardless of their declared domicile. This can become an issue if an individual domiciled elsewhere is present in the state for an extended period due to illness or unforeseen circumstances.

Since rules for residency and taxation change, periodic review is essential to avoid unintentional multi-state taxation.

While significant income and estate tax benefits can be obtained by changing your domicile, understanding the rules and proper planning are critical to avoid unintended consequences. If you have questions or would like to learn more, please fill out our contact form to schedule an appointment with our team.

1 Annual 2019 United Van Lines National Movers Study

2 Kiplinger State-By-State Guide to Taxes: www.kiplinger.com/tool/taxes/T055-S001-kiplinger-tax-map/index.php

The opinion of the author is subject to change without notice and must be considered in conjunction with relevant regulation, as well as subsequent changes in the marketplace. Any information from outside resources has been deemed to be reliable but has not necessarily been verified. Each individual has unique circumstances to which this information may or may not be relevant. Under no circumstances will this information constitute an offer to buy or sell and it does not indicate strategy suitability for any particular investor.