Installing a Cash Balance Pension Plan for 2020 – There’s Still Time

Per the SECURE Act (a bipartisan bill designed to aid Americans’ ability to save for retirement), a business owner now has until their tax filing deadline to install a 2020 Cash Balance Pension Plan. A Cash Balance Pension Plan is a pension plan with the option of a lifetime annuity and the business owner credits a participant’s account with a set percentage of their yearly compensation plus interest charges.

Benefits of a Cash Balance Pension Plan

The benefits of a Cash Balance Pension Plan are:

- Owners can contribute three to four times more than traditional defined contribution plans;

- Owners and partners can receive different contribution amounts;

- Contributions are tax deductible, saving the owner tens of thousands of dollars in annual taxes;

- At retirement (age 59.5) or at plan termination, all Cash Balance Plan assets can be rolled into another qualified plan or IRA.

A Cash Balance Pension Plan is not for Everyone

A Cash Balance Pension Plan may not be for you if:

- Owners or partners don’t want to contribute more than $50,000+ allowed in traditional retirement plans;

- Owners or partners aren’t willing or able to provide a generous contribution to staff in the 5% – 7.5% range; and

- Owners have not demonstrated consistent profit patterns.

How a Cash Balance Pension Plan Works

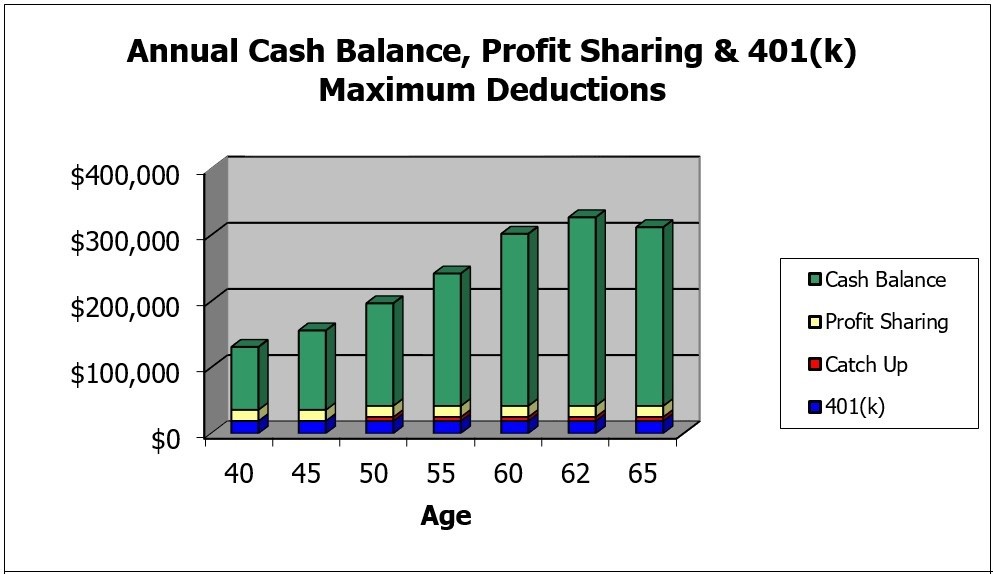

To make a Cash Balance Pension Plan function properly, owners must contribute to eligible staff and plan on keeping the cash balance in place for a minimum of five years. Below is a chart that shows estimates on the amount that can be saved in retirement plans by including a Cash Balance Pension Plan in your company’s retirement plan portfolio. As you can see, the older the owner or partner gets, the higher the contribution amount can be. The limits for Cash Balance Pension Plans are age based.

As an example, at Cornerstone Private Asset Trust Company, we implemented a Cash Balance Pension Plan for one of our clients, a company comprised of multiple owners and 10-15 staff members. The owners maximized their cash balance contributions at close to $200,000 each while providing a 5% contribution to the staff within the 401K plan. They are also able to include a handful of key employees in the Cash Balance Pension Plan to provide a higher contribution to them as a way of offering a “bonus” for their work. This is just one example. Each Cash Balance Pension Plan design is unique depending on the goals and demographics of the company.

Let us meet to determine if the Cash Balance Plan makes sense for your company. If a Cash Balance Plan isn’t a good fit, but you still want to contribute more to your company’s retirement plan, we will find a plan that allows the owners and/or highly compensated employees to receive a higher amount of profit sharing and/or maximize their deferral portion

If you have questions or would like to learn more, contact Joshua Rapp at Jrapp@cornerstonetrust.net or visit the Retirement Services page of Cornerstone’s website.