3 Impacts of Low Interest Rates

Key Takeaways:

Interest rates continue to remain low, and that seems to bug people. Yes, low rates are probably leading to some of the gains in the stock market. But a low interest rate environment also can be a good time to use insurance as a hedge against inflation or consider helping a child or grandchild buy a home.

A year ago, Associate Wealth Partner Ryan Nelson, wrote about your cash options in a low interest rate environment. Sitting on too much cash when rates are low, detracts from your portfolio returns. The irony of his post is that we are now a year later and still dealing with the same issue. Low interest rates continue to create problems that show up in different ways.

Investing

As we near year-end, it is natural for people to reassess their portfolios. The low interest rate environment leads to more investing in stocks since most bonds/cash are not yielding as much. The problem is knowing when the stock market might get soft—only hindsight will tell, but keep in mind that trends can sometimes outlast our attention spans by years. For most people, that means just staying invested.

Staying invested takes on new meaning in low interest rate environments. Low interest rates make investing in bonds harder to stomach, so people naturally tend to buy more stocks. But soon, stocks feel boring, and other investments start to look like they are worth the risk—Bitcoin, SPACs, and private equity all suddenly seem easy.

Everyone has their own risk tolerance, but I have found that people tend to invest, especially in riskier investments, without much due diligence. FOMO (or fear of missing out) becomes the rule, and that is usually when people get burned.

Long-Term Care Insurance

Insurance companies make money when they invest your premiums until somewhere down the road they have claims to pay. In low interest rate environments, it gets harder for insurance companies to make the returns they need on that cash.

In the case of long-term care insurance, insurance companies can request state insurance commissioners to increase the maximum premiums allowed to counter the lower returns. It makes sense if you think about it: You want your insurance company to be financially strong and solvent when

you have a claim somewhere in the future. Yet the premium increases that are coming in for long-term care insurance can seem high. Some policies are increasing premiums by 20% a year over the next three or four years to get on more solid ground.

While the insurance company always gives ways to slow down that premium increase, keep in mind that an insurance policy is a great hedge against inflation. Today’s premiums, albeit higher than you may have thought when you purchased the policy, are still being paid with dollars that would earn very little if left in cash. Yet medical expenses still increase faster than general inflation.

Real Estate

Whether you are in the market for real estate or not, your children or grandchildren might be. Prices have been rising steadily, and it is easy to say that home prices are higher today than 10 years ago. But are they unaffordable? Affordability is a different question.

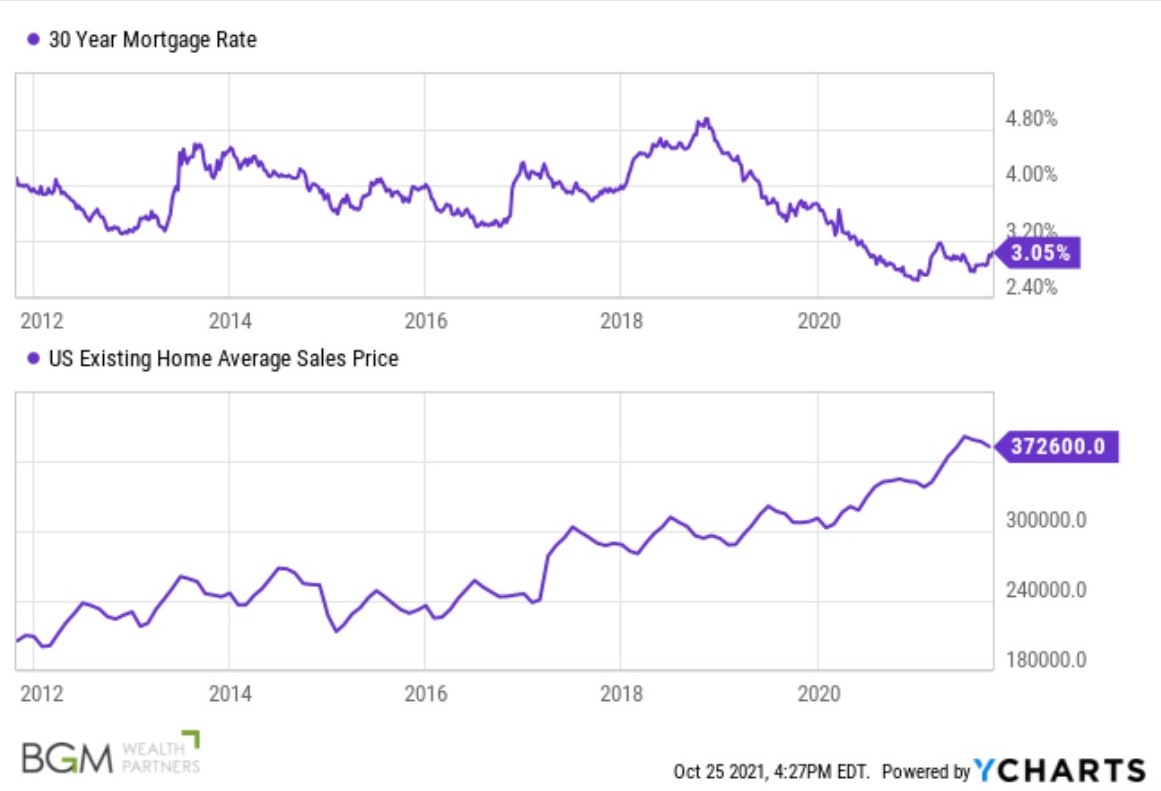

Many grew up on the notion that to buy real estate, you must put 20% down in cash. But most down payments are 3% to 6%, depending on loan type and credit score. While the U.S. Existing Home Average Sales Price is up 80% in a decade (now at $372,600), 30-year mortgage rates during that same time frame are down 25%, from 4.1% 10 years ago to 3.05% today.

An example of what this means is in order. In October 2011, a $205,900 home with a 5% down payment, 30-year fixed mortgage, and 4.1% mortgage rate would cost $945 per month in mortgage payments. Today, that same house would cost $372,600. To purchase it—again with a 5% down payment, a 30-year

fixed mortgage, and now a 3.05% mortgage rate—would cost $1,502 per month in mortgage payments. While $1,502 is more than $945, it is still within the realm of affordable (and I am not even touching the fact that many parents will help with larger down payments).

So Now What?

Interest rates are low and continue to stay low. Nobody knows when the Federal Reserve might start raising rates; everyone seems to think they can read the tea leaves, but really, nobody knows for sure. So instead of worrying about low interest rates, consider how you might use them to your advantage.

If you have questions or would like to learn more, contact Jon Meyer, CFP® at jmeyer@bgmwealth.com.

The opinion of the author is subject to change without notice and must be considered in conjunction with relevant regulation, as well as subsequent changes in the marketplace. Any information from outside resources has been deemed to be reliable but has not necessarily been verified. Each individual has unique circumstances to which this information may or may not be relevant. Under no circumstances will this information constitute an offer to buy or sell and it does not indicate strategy suitability for any particular investor.